Risk and Compliance Committee leads the initiatives for identifying risks and implementing concrete risk control measures that are appropriate for different types of risk, and ensuring operations comply with laws and regulations, etc. by conducting compliance training for all employees across the Group.

Basic Views on Internal Control System and the Progress of System Development

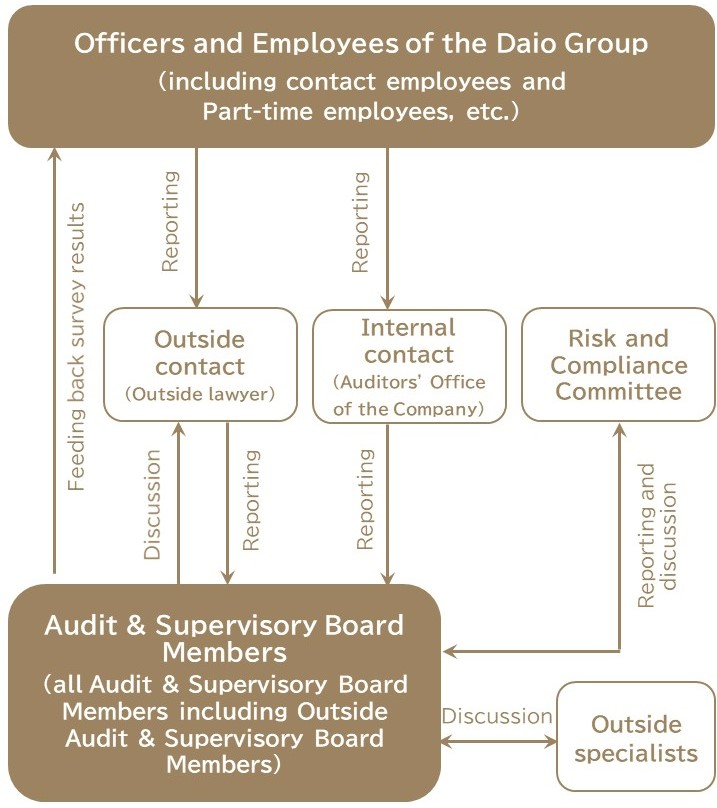

The Company resolved on the basic policy on the development of the internal control system at the Board of Directors meeting, and is currently working on the development of the system. The summary of the development of the system is as follows: 1) Framework to ensure that the executions of duties by the Group’s Directors and employees conforms to laws and regulations as well as the Articles of Incorporation (1) The Board of Directors makes decisions concerning critical management matters in accordance with the Rules for the Board of Directors. Each Director reports the condition of the execution of their duties to the Board of Directors as needed and monitors the conditions of the other Directors’ duties in a mutual manner. (2) The Company clearly defines decision-making authority and responsibility by job title according to the Official Authority Rules and the Approval Request Rules that are set forth by the Board of Directors. Directors and employees properly perform their duties by following these Rules. (3) In order to promote compliance and risk management, the Company establishes internal rules and the Risk Management and Compliance Committee, and appoints a director in charge of risk management and compliance to serve as the chairperson of the committee. (4) Under the direction of the director in charge of risk and compliance, the Risk Management and Compliance Committee deliberates and determines policies and measures for the development of the Group’s compliance and risk management systems, as well as monitors and evaluates these systems, and report the results to the Board of Directors as necessary. (5) The Risk Management and Compliance Committee establishes subcommittees as subordinate organizations as necessary, and the subcommittees report the progress of their initiatives to the Risk Management and Compliance Committee regularly. (6) The Company complies with laws and regulations and takes responsible actions based on its ethical view. i. As well as the “Daio Group’s Management Philosophy”, the Company set forth the “Daio Group Code of Conduct” and “Compliance rules” which specifies the Group’s officers’ and employees’ criteria for judgment, actions to be taken, and what are specifically prohibited to achieve the management philosophy , and the Company continuously educates and enlightens our Directors and employees. We regularly review the Internal Rules, and inform and raise awareness of the content thoroughly within the Company. ii. The Remuneration Committee conducts interviews as needed to evaluate actions of our full-time Directors in an effort to achieve a consensus over responsible conduct. (7) The Group has a Corporate Ethics Hotline as its whistle-blowing system, with an external lawyer serving as the contact for external services and the Auditor’s Office for internal services. We specify the obligation to report any ethical and disciplinary issues as well as violations of laws that one has learned about, consideration for whistle-blowers’ privacy, and protection of whistle-blowers from disadvantageous treatment, among others, in the rules on the operation of the system, and make a company-wide announcement of the system to promote for using the whistle-blower system. (8) We require our subsidiaries that they comply with laws and regulations, and that they establish necessary rules, inform and educate the content thoroughly within the company, and fulfill their duties with a great sense of ethics. (9) As a rule, we assign our officers and employees to the posts of part-time directors or auditors at our subsidiaries so that they watch how the subsidiaries’ representative directors and executive directors execute their duties. (10) We regularly provide information about compliance for our officers, employees, and officers of our subsidiaries and give compliance training. 2) Framework to save and manage information about the execution of duties by Directors at the Company We properly save and manage critical information and documents about the execution of duties by Directors and management decision-making in accordance with the Internal Rules established for proper management of document data. Directors as well as Audit and Supervisory Board Members may access to these information and documents as needed. 3) Rules and other frameworks to manage the risk of loss for the Group (1) The Risk and Compliance Committee establishes internal rules to promote risk management and identifies and assesses the risks that may have a serious effect on our business so that appropriate actions according to the severity of the risks are taken, thereby preventing these risks from becoming a reality. The Committee also deliberates on policies and measures to manage important risks, and provide a complete company-wide risk management structure based on decisions by the Board of Directors. (2) The Company provides guidance, supervision, and support for subsidiaries to identify and assess risks that may have a serious effect on subsidiaries’ business so that appropriate actions are taken to prevent materialization of those risks. (3) The Group establishes The Crisis Management Rules and the Daio Group’s BCM (Business Continuity Management) Basic Rules which specify our crisis management structure in preparation for natural disasters or any other emergencies that may cause a significant loss to the company. The Group ensures that all our officers and employees follow these Rules. (4) In case of any unforeseen emergency, we follow the Crisis Management Rules and the Daio Group’s BCM (Business Continuity Management) Basic Rules to quickly set up an internal system according to the severity of the possible effect on the Group in order to minimize losses and continue and restore business operations, while identifying the cause and taking measures to prevent a recurrence. (5) To fully conform to the internal control and reporting system pertaining to financial reporting that is based on the Financial Instruments and Exchange Act, the Group continues to develop and operate effective and efficient internal control and make necessary corrections, thereby ensuring the reliability and appropriateness of our financial reporting. 4) Framework to ensure that the Group’s Directors efficiently execute their duties (1) We provide the Segregation of Duties Rules, the Official Authority Rules, and the Approval Request Rules in order to clearly define the scope of Directors’ responsibility and their official authority, so that our units play their own roles while properly cooperating with one another. (2) To ensure quick decision-making, efficient management, and enhancement of business execution function, the Board of Directors makes critical management decisions and supervises business execution, and the Management Meeting, which consists of the management team members, makes decisions on matters delegated by the Board of Directors, thereby adapting to changes in the business environment. (3) We have the executive officer system in place in order to make quick and courageous management decisions and establish a robust and flexible business execution structure by clearly defining the roles and responsibilities of the Board of Directors makes decisions on critical management matters and supervises business execution, and Executive Officers. The Board of Directors and Executive Officers execute operations. 5) Framework to ensure appropriate operations across the Group (1) We submit subsidiaries’ board meeting minutes to the heads of the Units at the Company that are responsible for these subsidiaries and the relevant Business Groups. (2) We establish internal rules for appropriate management, supervision, and support of subsidiaries and affiliates which specify the matters that must be approved by or reported to the Company. 6) Matters regarding employees when the Company’s Audit and Supervisory Board Members request that they have an employee as an assistant who will help with their duties; matters regarding independence of an employee from the Company’s Directors We set up the Auditor’s Office to which an employee is assigned so that he or she will assist with Audit and Supervisory Board Members’ work. Appointment of an employee and any decisions about matters pertaining to authority over personnel affairs, including transfers, require prior approval from a full-time Audit and Supervisory Board Member. 7) Matters regarding ensuring the effectiveness of instructions given to the employee assigned to the Company’s Audit and Supervisory Board Members as stated in the preceding item The employee in the Auditor’s Office shall work exclusively for the Audit and Supervisory Board Members to whom he or she is assigned. The employee is independent from Directors’ authority over reporting lines. 8) Framework for reporting to the Company’s Audit and Supervisory Board Members by a person who has received a report from the Group’s Director or a subsidiary’s director The Group’s directors and employees report the status of business execution, results of internal audit, and other material matters regularly to Audit and Supervisory Board Members. If they come to know any material facts, such as violations of laws and regulations or any other compliance matters, promptly report to Audit and Supervisory Board Members. 9) Framework to ensure that the person who has made a report as stated in the preceding item will not be subject to disadvantageous treatment due to the reporting The Group prohibits any disadvantageous treatment of a person who has made a report to Audit and Supervisory Board Members on the ground that he or she has made the report. 10) Matters regarding policies pertaining to the procedure for the advance payment or reimbursement of expenses incurred in the performance of duties by the Company’s Audit and Supervisory Board Members, and to other expenses that are incurred in the performance of those duties or debt disposal that occurs from it We pay expenses incurred in connection with the performance of duties by Audit and Supervisory Board Members, except when we prove that those expenses are unnecessary for the performance of duties by Audit and Supervisory Board Members. 11) Other framework to ensure effective audits by the Company’s Audit and Supervisory Board Members Audit and Supervisory Board Members have regular meetings with President and Representative Director to exchange opinions about matters pertaining to audits. They work closely with internal control units, including the relevant Business Groups, and the Internal Audit Department in order to perform effective audits.

Schematic Diagram of Corporate Ethics Hotline

Establishment of Risk and Compliance Committee

To strengthen risk management and compliance at the Daio Paper Group. It checks the Group’s risk management framework by comprehensively identifying and assessing risks of the Group and by implementing unified management of its risk control measures. It also makes deliberations, etc. on risk control measures in accordance with the severity of risks. Further, the Risk and Compliance Committee establishes subcommittees as subordinate organizations as necessary, and the subcommittees report the progress of their initiatives to the Risk and Compliance Committee regularly. Each subcommittee deliberates, makes decisions, and implements specific measures for each type of risk, forming a highly effective risk management system.

Establishment of Daio Group Code of Conduct

The Daio Group has established the Daio Group Code of Conduct to serve as a standard of judgment for all officers and employees of the Daio Group to act sincerely and appropriately with high ethical standards, as well as to comply with the laws and regulations of the relevant countries, and we are working to thoroughly familiarize and educate officers and employees.

Responding to the risk of bribery

The Daio Group declares in the “Daio Group Code of Conduct” that it will not tolerate bribery that hinders the stability of the social system and fair competition. In response, we have established the “Daio Group Anti-Bribery Policy” as the Group’s basic policy, and have also developed the “Daio Group Anti-Bribery Rules” and other related internal regulations to ensure their effectiveness in our business activities, and are working toward the prevention of bribery.